Ministry of Finance

GOVERNMENT MAKES NEW TAX REGIME MORE ATTRACTIVE

STANDARD REDUCTION INCREASED FROM Rs. 50,000 TO Rs. 75,000

SALARIED EMPLOYEE STANDS TO SAVE UP TO Rs. 17,500

Posted On: 23 JUL 2024 1:14PM by PIB Delhi

Several attractive benefits to provide tax relief to salaried individuals and pensioners opting for the new tax regime were announced by the Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman while presenting the Union Budget 2024-25 in the Parliament today.

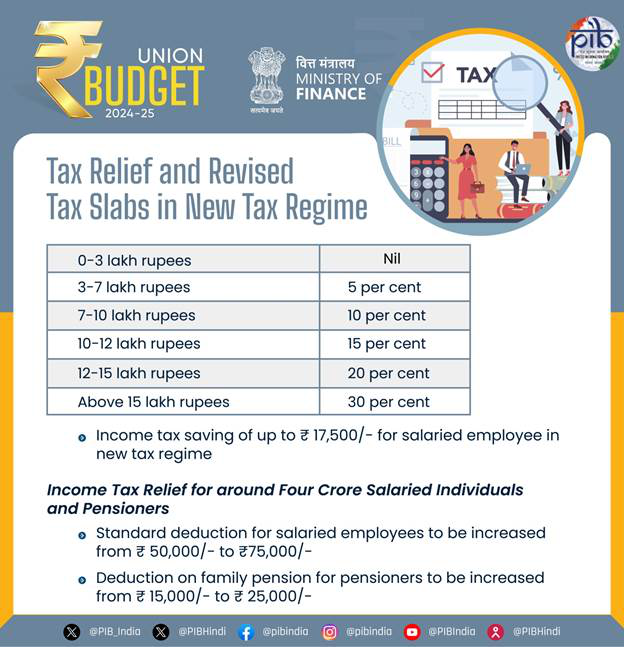

Finance Minister proposed to increase the standard deduction for salaried employees from Rs.50,000 to Rs.75,000. Also, deduction on family pension for pensioners is proposed to be enhanced from Rs.15,000 to Rs.25,000 under the new tax regime. This will provide relief to about four crore salaried individuals and pensioners.

Smt. Sitharaman proposed to revise the tax rate structure in the new tax regime, as follows:

As a result of these changes, a salaried employee in the new tax regime stands to save up to Rs. 17,500 annually in income tax.

For more information click here to subscribe our library |